U.S. Backs Argentina with $20 Billion Aid Package, Citing Strategic Investment

Treasury Secretary Bessent Affirms Support for Milei Amidst Geopolitical Tensions

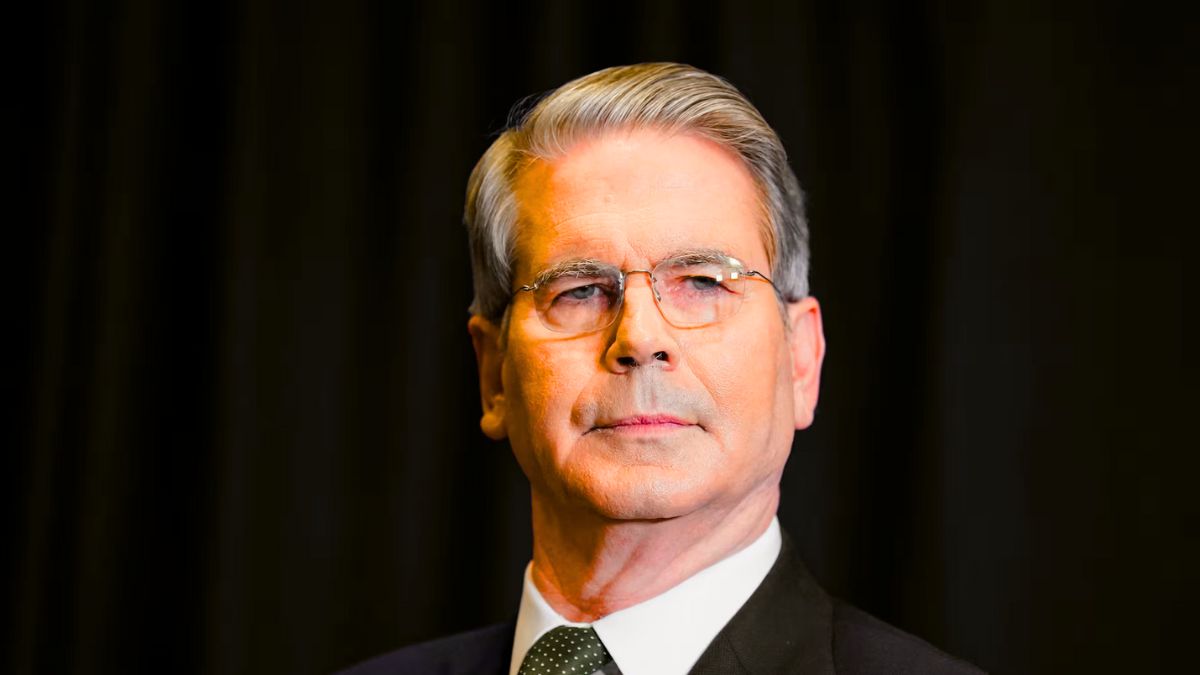

WASHINGTON D.C. – In a significant move to stabilize the Argentine economy, United States Treasury Secretary Scott Bessent has announced a $20 billion currency swap in support of President Javier Milei’s administration. Bessent emphasized that stabilizing Argentina is a key priority for the U.S., framing the financial assistance not as a bailout but as a strategic investment, highlighting the current undervaluation of the Argentine peso.

The U.S. is actively engaged in purchasing Argentine pesos to bolster the exchange rate, with Bessent indicating that the current exchange rate band is appropriate. This financial backing comes as the U.S. seeks to prevent “another failed or China-led state in Latin America,” a sentiment expressed by Bessent.

However, these remarks have drawn a swift response from the Chinese Embassy in Argentina. A spokesperson for the embassy stated that the U.S. should focus on practical steps for the development of Latin American and Caribbean countries, rather than impeding friendly cooperation with other nations. The spokesperson further asserted that Latin America and the Caribbean is not any nation’s “backyard,” and that cooperation with China should remain free from third-party interference.

The unfolding economic and geopolitical dynamics are further complicated by recent threats from former President Donald Trump, who yesterday warned of a “massive increase” in tariffs on Chinese imports. Trump cited Beijing’s new export controls on rare earth minerals as the reason for his potential action and also suggested he might cancel a planned meeting with President Xi Jinping over the escalating tensions.